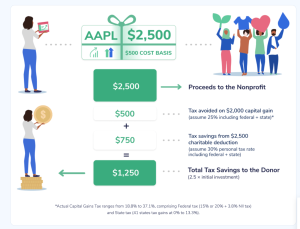

Did you know that when you donate stock, you avoid the tax on the gain while deducting 100% of the value of the contribution? When you give stock, you may earn 2-3x the tax savings vs. donating cash. It’s a win-win for you and us. And now it’s fast, safe and easy to do.

Did you know that when you donate stock, you avoid the tax on the gain while deducting 100% of the value of the contribution? When you give stock, you may earn 2-3x the tax savings vs. donating cash. It’s a win-win for you and us. And now it’s fast, safe and easy to do.

Sepsis Alliance has partnered with DonateStock.com to enable our supporters to make stock donations in 10 minutes or less. Our DonateStock page https://donatestock.com/

So remember, charitable giving doesn’t always mean cash. By giving stock, your support will have even greater impact. Give smart and save more by putting stock in something that matters.